As indicated in the latest market research report published by IMARC Group, titled "India Set-Top Box Market Size, Share, Trends and Forecast by Type, Resolution, End User, Service Type, Distribution, and Region, 2025-2033," this report provides an in-depth analysis of the industry, featuring insights into the market. It encompasses competitor and regional analyses, as well as recent advancements in the market.

Market Size & Future Growth Potential

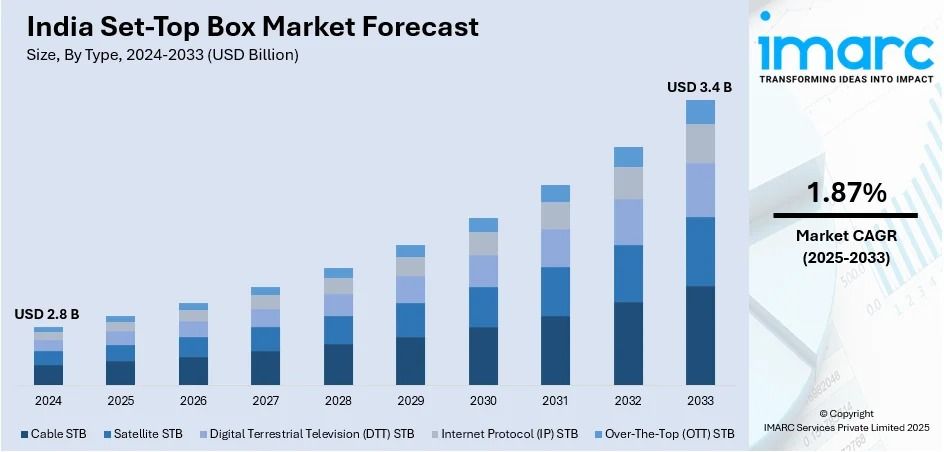

The India set-top box market size reached USD 2.8 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.4 Billion by 2033, exhibiting a growth rate (CAGR) of 1.87% during 2025-2033.

Latest Market Trends

The Indian set-top box market is experiencing a fundamental transformation driven by the integration of Over-the-Top (OTT) services with conventional set-top boxes, offering users unified access to live television and on-demand content. This convergence represents a significant shift as manufacturers launch hybrid STBs that combine traditional broadcasting with streaming capabilities.

The 4K set-top box segment is demonstrating remarkable growth potential, with the market expected to reach USD 183.3 million by 2030, driven by increasing availability of 4K content and affordable high-resolution displays. This advancement ensures sharper and more immersive viewing experiences as consumers upgrade their entertainment systems.

Smart TVs are rapidly becoming the primary medium for OTT content consumption, fundamentally changing how Indian households access entertainment. The India Smart TV and OTT market size is estimated at USD 22.39 billion in 2025, reflecting the massive shift toward connected viewing experiences.

The rise of streaming services and on-demand content has created new requirements for set-top box functionality. Manufacturers are responding by developing advanced STB variants that support video conferencing, home networking, video-on-demand, and Internet Protocol (IP) telephony capabilities, transforming these devices into comprehensive entertainment hubs.

Digital transformation initiatives are pushing the boundaries of traditional set-top box design, with manufacturers integrating artificial intelligence, voice control, and personalized content recommendations to enhance user experiences and compete with smart TV platforms.

Request Free Sample Report: https://www.imarcgroup.com/india-set-top-box-market/requestsample

Market Scope and Growth Factors

The market scope is expanding significantly as India's broadcasting landscape undergoes comprehensive digitization. The continuous development of advanced set-top box variants with multiple complex functions is driving adoption across residential and commercial segments, creating opportunities for feature-rich solutions.

TRAI's regulatory changes have profoundly altered the pay-TV scene, with the removal of network capacity charges for DTH users making television services more affordable and flexible. This regulatory shift aims to reduce customer migration toward OTT platforms while supporting competitive pricing structures.

The Indian broadcasting market now hosts 333 pay channels and 918 satellite TV channels, providing extensive content variety that drives demand for sophisticated set-top box solutions. However, active pay DTH subscriptions fell from 58.22 million in December 2024 to 56.92 million in March 2025, indicating market consolidation and the need for enhanced value propositions.

Government initiatives supporting digital broadcasting infrastructure continue to create opportunities for market expansion. New satellite communication rules introduced in 2025 emphasize localization requirements, with satcom firms mandating 20% indigenous production of ground segments by Year 5, supporting domestic manufacturing growth.

Rising disposable incomes, improving living standards, and rapid urbanization are increasing adoption of direct-to-home (DTH) services and smart TVs. Urban consumers increasingly demand seamless entertainment experiences that combine traditional broadcasting with streaming services.

The residential segment dominates market share, driven by growing demand for home entertainment systems that offer both traditional TV viewing and streaming capabilities. Commercial applications are also expanding as businesses require sophisticated audiovisual solutions for conferencing and digital signage applications.

IMARCs report provides a deep dive into the India set-top box market analysis, outlining the current trends, underlying market demand, and growth trajectories.

Comprehensive Market Report Highlights & Segmentation Analysis

Segmentation by Type:

- Cable STB

- Satellite STB

- Digital Terrestrial Television (DTT) STB

- Internet Protocol (IP) STB

- Over-The-Top (OTT) STB

Segmentation by Resolution:

- HD (High Definition)

- SD (Standard Definition)

- UHD (Ultra-High Definition)

Segmentation by End User:

- Residential

- Commercial

- Others

Segmentation by Service Type:

- Pay TV

- Free-to-Air

Segmentation by Distribution:

- Online Distribution

- Offline Distribution

Regional Segmentation:

- North India

- West and Central India

- South India

- East India

Competitor Landscape:

The report offers an in-depth examination of the competitive landscape. It includes a thorough competitive analysis encompassing market structure, key player positioning, leading strategies for success, a competitive dashboard, and a company evaluation quadrant.

Explore the Full Report with Charts, Table of Contents, and List of Figures: https://www.imarcgroup.com/india-set-top-box-market

Recent News and Developments

- June 2025: Industry report highlighted prominent trend of merging OTT services with conventional set-top boxes, offering unified access to live television and on-demand content

- May 2025: New satellite communication guidelines introduced localization requirements, mandating 20% indigenous production of ground segments by Year 5 to support domestic manufacturing

- April 2025: 4K set-top box market projected to reach USD 183.3 million by 2030 with compound annual growth rate of 12.9%, driven by high-resolution content demand

- March 2025: Active pay DTH subscriptions declined to 56.92 million from 58.22 million in December 2024, indicating market consolidation amid OTT platform competition

- 2025: TRAI removed network capacity charges for DTH users, making television services more affordable and flexible for consumers across India

- 2025: Manufacturers launched hybrid set-top boxes combining traditional broadcasting with streaming capabilities to meet changing consumer entertainment preferences

- 2025: Smart TV adoption accelerated as primary medium for OTT content consumption, with India Smart TV and OTT market reaching USD 22.39 billion

- 2025: Advanced STB variants introduced with AI integration, voice control, and personalized content recommendation features to enhance user experience

- 2025: Government initiatives promoted digital broadcasting infrastructure development, creating opportunities for domestic set-top box manufacturing expansion

- 2025: 4K and 8K streaming capabilities adoption increased as high-resolution displays became more affordable for Indian consumers

Key Highlights of the Report

- Historical Market Performance

- Future Market Projections

- Impact of COVID-19 on Market Dynamics

- Industry Competitive Analysis (Porter's Five Forces)

- Market Dynamics and Growth Drivers

- SWOT Analysis (Strengths, Weaknesses, Opportunities, Threats)

- Market Ecosystem and Value Creation Framework

- Competitive Positioning and Benchmarking Strategies

Major Advantages of the Report

- This report provides market leaders and new entrants with accurate revenue estimates for the overall market and its key subsegments.

- Stakeholders can leverage this report to gain a deeper understanding of the competitive landscape, enabling them to strategically position their businesses and develop effective go-to-market strategies.

- The report provides stakeholders with valuable insights into the market dynamics, offering a comprehensive analysis of key drivers, restraints, challenges, and opportunities.

Why Choose IMARC Group

- Extensive Industry Expertise

- Robust Research Methodology

- Insightful Data-Driven Analysis

- Precise Forecasting Capabilities

- Established Track Record of Success

- Reach with an Extensive Network

- Tailored Solutions to Meet Client Needs

- Commitment to Strong Client Relationships and Focus

- Timely Project Delivery

- Cost-Effective Service Options

Ask an analyst: https://www.imarcgroup.com/request?type=report&id=2652&flag=C

Note: Should you require specific information not included in the current report, we are pleased to offer customization options to meet your needs.

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

Contact US

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

Americas: +1-201971-6302 | Africa and Europe: +44-702-409-7331